Prepaid Cards for Canadian Online Casinos

Online gamblers in Canada can face hurdles when it comes to casino banking. However, there are solutions for nearly everyone. Each consumer has their own preferences in payment processing and each major financial institution has placed certain inconveniences in players’ paths for a variety of reasons.

Whether or not you have an account at a bank or credit union, prepaid cards like those offered by Visa and Mastercard can be a very convenient solution for depositing at a reputable offshore casino.

In this article, we’ll explore the different types of prepaid cards, help you find one that’s right for you, and explore some of the terms and conditions of particular cards that indicate you may not be able to use them for depositing at online casinos in Canada.

Top Prepaid Card Casinos

Varieties of prepaid cards

Prepaid cards can be a nearly anonymous way for people to deposit at their favorite online casinos. Most places that accept bank-badged Visa or Mastercard will also accept almost any other prepaid card from the most popular payment solutions companies.

They work much like a gift card and may look nearly identical to a debit card or credit card, but there are distinct differences between them.

Secured credit cards should not be confused with prepaid cards

Here’s why…

Whilst a consumer must deposit as much money as the “credit limit” they desire in order to use a secured credit card, they are another financial instrument altogether. For the sake of this article, we will simply note that a secured credit card can often be used for casino deposits, but they are best suited to building or restoring credit.

They can be an expensive alternative to true prepaid cards with consumers paying exorbitant interest rates to ‘borrow’ their own money and earning little or no interest on the money they have used to secure the “credit”. We do not suggest using a secured credit card for gambling purposes.

Prepaid Cards…

- Are usually not linked to a bank account or credit union account

- Usually do not have your name on them

- Are only as valuable as the amount you have loaded

- Can be reloaded or may be for single load use

- Can be virtual, physical, or both

- Cannot be re-loaded with winnings from an online casino

- May have fees associated with them (activation, per-use, or foreign transaction fees)

Prepaid cards are not debit cards…

…but they are more like a debit card than a credit card.

Although the card must have value added to it in order to make purchases or deposit with it at a casino, it won’t be linked to your financial institution.

This means that you can keep funds in your bank account or credit union share account and still use a prepaid card for purchases without affecting the balance(s) at your financial institution(s).

It also means you don’t even have to have a checking or savings account to use a prepaid card. Many people choose to be among the “unbanked” population for personal or financial reasons. Prepaid cards are an excellent tool to help some people stick to a budget.

Again… prepaid cards are not credit cards…

You can’t borrow money with a prepaid card and then make monthly installment payments on it. The value you load on the card is the only value it has. You won’t pay interest on the card but there may be fees.

You don’t need good credit to purchase prepaid cards… but they won’t help you build credit either.

One-time load vs. Reloadable cards

Some prepaid cards, including gift cards, are only good until the value that has initially been loaded on them is spent. As soon as the loaded funds run out, they can’t be reloaded.

With any prepaid card be sure to look for the words: “For use only in Canada“. If your card has those words on it, it is a “Domestic Use Only” card and will not work at offshore casinos with international overseas banking.

One-time load cards

Some prepaid cards can be purchased on a display kiosk at a grocer, drugstore, or even a gas station. Vanilla offers both single-use and reloadable (registered) cards.

Players can purchase single-use cards at a variety of convenient locations including Walmart.

To learn more about Vanilla and Canadian online casinos that accept them, please visit our Vanilla Prepaid Casino Sites page.

Any Visa or Mastercard that can be used for international purchases (not marked “for use in Canada only”) should be accepted at an online casino that accepts the Visa or Mastercard brand.

Disposable Vanilla Prepaid Visa and Mastercards:

- Are accepted worldwide (offshore casinos)

- Require no PIN

- Available in various denominations

Visa: $25, $50, $75, $150, $250

Mastercard: $25, $50, $60 (3 x $20), $100, $200 - Do not need to be registered and cannot be reloaded. The card will be activated upon purchase and has no value prior to activation.

Things to consider about single-use prepaid cards…

Like almost any other alternative online casino deposit method for Canadians, there is only one way to be certain that it will work – you’ll have to try it.

Yes, you can ask a customer service representative if a certain brand of Visa or Mastercard will work, but you may have to actually try it to find out for sure.

If you have a gift card or another prepaid that simply doesn’t work where you want to play, and it holds your gambling budget, check out one of our other casino deposit methods that can be funded with a prepaid card:

EcoPayz – Buy an ecoVoucher with your prepaid to top up your ecoPayz account

- Find a nearby sales outlet using the ecoPays search tool.

- Go to the TopMeUp website to purchase a voucher online.

You can also visit TopMeUp and use a prepaid card to purchase casino deposit vouchers from:

Prepaid cards can be used to fund a MuchBetter wallet or top up a mobile account and then use it to deposit funds with Boku.

- MuchBetter – You can load an e-Wallet such as MuchBetter with a prepaid card and then use the wallet for deposits, etc

- Boku – Use Boku to fund your casino account. Pay or top up your mobile phone account with a prepaid card

It may be inconvenient to find yourself in possession of a prepaid that won’t work for deposits, but the good news is that the funds can be used at another online vendor or local retail shop no matter what, so you won’t actually be out any money by making the attempt.

To reiterate a key point about prepaid cards…

If the card is good for online and international purchases and does not state that it is only valid in Canada, you should be able to deposit just as if it were a bank-badged card, but without a big 5 bank’s online gambling policies interfering.

Reloadable Prepaid Cards

The larger Canadian financial institutions often place restrictions on the use of their prepaid cards for activities like online gambling. Some users report success in using the cards anyway. The following snippets are from the institutions’ respective terms and conditions:

CIBC Smart Prepaid Visa – Available – “We may block transactions that we can identify as  internet gambling or other cash-like transactions.” (Terms.PDF) The operative words are “may block” and “can identify”. Users report some success with this card.

internet gambling or other cash-like transactions.” (Terms.PDF) The operative words are “may block” and “can identify”. Users report some success with this card.

CIBC Air Canada multi-currency prepaid – Available – No bank account needed, app is available, load on the go, accepted internationally, no credit check (Terms.PDF)

TD Connect Prepaid Visa – Available – “You cannot use Your Card in connection with an Internet gambling transaction.” (Terms.PDF) Perhaps they should have stated, “you may not…” online casinos can be quite creative when it comes to defending your right to play where you choose to play.

RBC Visa Prepaid cards – Discontinued – Not to be used “…for certain types of transactions including those connected to Internet gambling.”

Scotiabank Prepaid Reloadable – Discontinued

BMO Prepaid Mastercard – Available – Reloadable secured credit card

Mastercard Prepaid Travel Card – Available – Accepted online and for offshore transactions depending on the issuer

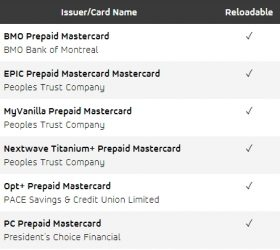

You can click the image above to go to a secure Mastercard page with links to the listed prepaid card providers.

More options

EcoPayz has several products that can be used in Canada. You can read all about “how it works” on our EcoPays Casinos page.

If you mostly wish to learn about the Payz Card, you can visit the card’s home page here.

Cards are issued, activated, renewed or canceled free of charge. An ecoWallet may be required to use the physical card. CAD is available in your ecoAccount, but the cards only work in USD, GBP, and EUR. Eco charges 2.99% for currency conversions using any of their products.

UnionPay Global Prepaid – Provided by the Bank of China (Canada) this card is accepted  wherever UnionPay cards are accepted. You can apply for UnionPay Prepaid.

wherever UnionPay cards are accepted. You can apply for UnionPay Prepaid.

Mogo Visa Platinum Prepaid: We have not tried this card yet, but there doesn’t seem to be anything in the T&C prohibiting online casino deposits (Terms.PDF)

Note: You can also get the Mogo app to exchange crypto, but you won’t be able to link your MogoCard and spend “MogoCrypto” with the card.

Koho Reloadable – A new age app-based spending account with a reloadable prepaid physical Visa card. Your money is safely held at Peoples Trust and insured by the Canada Deposit Insurance Corporation (CDIC).

A non-reloadable prepaid is also available. “…use may be restricted by some online merchants.”

Funds from either kind of card can be added to a mobile wallet. However, terms do state that online gambling is not allowed. In practice, results may vary.

Canada Post Prepaid Cards

Cash Passport Mastercard and Canada Post Prepaid Reloadable Visa:

Each card has a restriction on the terms and conditions against online gambling. However, some users report success in using them.