Payz, formerly known as ecoPayz, is an e-wallet that started out life as EcoCard in 2000 and has now established itself as one of the premium online payment systems. The primary advantage that ecoPayz Online Casinos bring to Canadian online gamers is the added layer of security it provides by not requiring you to share your financial details (such as bank account and credit card numbers) directly with the casino.

See our choice of the best Canadian online casinos accepting ecoPayz in the table below:

Best Casinos that offer Payz

How Does Payz Work?

In this article, we highlight the advantages/disadvantages of using ecoPayz and how to go about using it as a payment method at online casinos.

Depositing with ecoPayz

[su_icon icon=”icon: thumbs-up” color=”green” text_color=”black”] Advantages of using ecoPayz[/su_icon]

Safe and Secure: The first and probably most important of these is that it is safe and secure reducing the risk of your financial details being stolen or used inappropriately.

Safe and Secure: The first and probably most important of these is that it is safe and secure reducing the risk of your financial details being stolen or used inappropriately.

The reason for this is that you only share your bank details and/or credit card numbers with ecoPayz not the online casino where you play (or any other third party for that matter).

All transactions are anonymous and so the casino where you deposit funds is not privy to your personal details. All transactions using ecoPayz are encrypted from your browser using Secure Sockets Layer protocol or its successor Transport Layer Security protocol, depending on your browser capabilities.

Immediate Deposits: In terms of getting your casino account up and running, deposits made using ecoPayz will hit your account instantaneously. A good number of online casinos accept ecoPayz as a payment method, making it a valuable tool irrespective of where you decide to play. Similarly unlike some other payment methods you can use it to withdraw funds from your casino account as well.

Keeping tabs on deposits: Being a digital wallet similar to iDebit rather than a credit card means that you are more able to keep tabs on your bankroll management ensuring that you are only playing with money that you have available. This avoids the risk of unknowingly running up credit card bills or moving into your overdraft.

Accessibility: Operating an ecoPayz account is easy and straightforward and your account is always accessible. The site can be accessed from your mobile and iOS and Android users can download an app for greater convenience. Similarly, there are a variety of different methods to deposit funds into an ecoPayz account including bank wire transfer, credit cards and alternative digital wallets. No matter where you bank, who you bank with or how you run your financial affairs, getting cash into your ecoAccount is always quick and convenient.

[su_icon icon=”icon: thumbs-down” color=”red” text_color=”black”] 2 Disadvantages of using ecoPayz[/su_icon]

Depositing funds charge: Although it is free to transfer cash from your ecoPayz to your casino account, there is a charge for depositing funds into ecoPayz, ranging from between 1.69% – 2.9% (depending on the region you live in).

And while it is possible to make payments to merchants and service providers in 45 different currencies, there is nevertheless a currency conversion fee charged if you transfer money in a currency other than that you used to make a deposit (between 1.25% – 2.99% depending on your Membership level).

ecoPayz Account Fees

Depending on your account membership status, ecoPayz charges the following fees:

Transaction Type |

Fees |

|---|---|

| Registration | FREE |

| Bank Wire Deposit (electronic funds transfer, instant deposit, local or international bank deposit, local services) |

0-7% |

| Credit Card Deposit | 1.69-2.90% |

| EcoVoucher Deposit | 0.00 – 2.90% |

| Alternative Currency Deposit | FREE |

| Withdrawal to Bank Account | N/A |

| Inter-Account Transfer | N/A |

| Transfer to another ecoAccount | N/A |

| Transfer to ecoPayz Merchant | FREE |

| Currency Conversion | 2.99% |

| Account maintenance after inactivity of 12 months | $2.24 CAD per month |

Transaction Type |

Fees |

|---|---|

| Registration | FREE |

| Bank Wire Deposit (electronic funds transfer, instant deposit, local or international bank deposit, local services) |

0-7% |

| Credit Card Deposit | 1.69-2.90% |

| EcoVoucher Deposit | 0.00 – 2.90% |

| Alternative Currency Deposit | FREE |

| Withdrawal to Bank Account | $8.80-$14.92 CAD |

| Inter-Account Transfer | FREE |

| Transfer to another ecoAccount | 1.5% |

| Transfer to ecoPayz Merchant | FREE |

| Currency Conversion | 2.99% |

| Account maintenance after inactivity of 12 months | $2.24 CAD per month |

Transaction Type |

Fees |

|---|---|

| Registration | FREE |

| Bank Wire Deposit (electronic funds transfer, instant deposit, local or international bank deposit, local services) |

0-7% |

| Credit Card Deposit | 1.69-2.90% |

| EcoVoucher Deposit | 0.00 – 2.90% |

| Alternative Currency Deposit | FREE |

| Withdrawal to Bank Account | $8.80-$14.92 CAD |

| Inter-Account Transfer | FREE |

| Transfer to another ecoAccount | FREE |

| Transfer to ecoPayz Merchant | FREE |

| Currency Conversion | 1.49% |

| Account maintenance after inactivity of 12 months | $2.24 CAD per month |

Transaction Type |

Fees |

|---|---|

| Registration | FREE |

| Bank Wire Deposit (electronic funds transfer, instant deposit, local or international bank deposit, local services) |

0-7% |

| Credit Card Deposit | 1.69-2.90% |

| EcoVoucher Deposit | 0.00 – 2.90% |

| Alternative Currency Deposit | FREE |

| Withdrawal to Bank Account | $8.80-$14.92 CAD |

| Inter-Account Transfer | FREE |

| Transfer to another ecoAccount | FREE |

| Transfer to ecoPayz Merchant | FREE |

| Currency Conversion | 1.49% |

| Account maintenance after inactivity of 12 months | $2.24 CAD per month |

Transaction Type |

Fees |

|---|---|

| Registration | FREE |

| Bank Wire Deposit (electronic funds transfer, instant deposit, local or international bank deposit, local services) |

0-7% |

| Credit Card Deposit | 1.69-2.90% |

| EcoVoucher Deposit | 0.00 – 2.90% |

| Alternative Currency Deposit | FREE |

| Withdrawal to Bank Account | $4.33-$10.44 CAD |

| Inter-Account Transfer | FREE |

| Transfer to another ecoAccount | FREE |

| Transfer to ecoPayz Merchant | FREE |

| Currency Conversion | 1.25% |

| Account maintenance after inactivity of 12 months | $2.24 CAD per month |

ecoPayz Business Account Fees

Transaction Type |

Fees |

|---|---|

| Registration | FREE |

| Bank Wire Deposit (electronic funds transfer, instant deposit, local or international bank deposit, local services) |

0-7% |

| Alternative currency deposit | FREE |

| Withdrawal to Bank Account | $8.80 – $14.92 CAD |

| Inter-Account Transfer | FREE |

| Transfer to another ecoAccount | 1% |

| Transfer to another ecoPayz business account | 1.5% |

| Currency Conversion | 2.99% |

| Account maintenance after inactivity of 12 months | $7.46 CAD per month |

Dormant Account: A further potential disadvantage is that if your account remains dormant for 12 months, you’re then charged a monthly recurring fee, although for regular online casino players who use ecoPayz as their main e-wallet this shouldn’t prove to be too much of an issue.

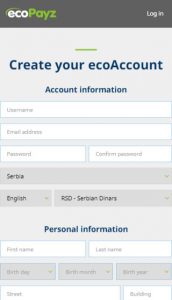

How to set up a ecoPayz account

The first step to setting up an ecoPayz account is to visit www.ecoPayz.com. There you can get an overview of their services and be taken through the sign up procedure.

The first step to setting up an ecoPayz account is to visit www.ecoPayz.com. There you can get an overview of their services and be taken through the sign up procedure.

To sign up you need to:

- Create a username and password

- Provide a valid email address

- Denote your country of residence, the language you wish to communicate in and your home currency

- Provide personal information, including name and address, phone number and your date of birth

- You will then be sent a confirmation email to fully activate your account.

Thee are four different account levels – Classic, Silver, Gold and Platinum – and the services offered and the fees charged are in accordance with the level you have attained, which is calculated according to your account activity.

Thee are four different account levels – Classic, Silver, Gold and Platinum – and the services offered and the fees charged are in accordance with the level you have attained, which is calculated according to your account activity.

On joining, you are instantly given Classic status, although to gain the most from ecoPayz’s services you should seek to upgrade to Silver as soon as possible. This is relatively straightforward to do and requires you to provide identification documentation, such as a copy of your passport or driver’s licence, and proof of your address e.g., a utility bill, a bank statement, etc.

There are a wide variety of methods you can use to transfer funds to your ecoPayz casinos account, either using direct bank transfer or via a credit/debit card. Depositing funds is quick and easy, with the fee charged dependent upon the method used and the region in which you live.

Funding your EcoPayz account

EcoPayz provides quite a diverse amount of depositing options to fund your account which includes:

- Debit Card/Credit Card

- EcoVoucher

- Neosurf

- EFT

- pocketchange

- Interac Online

- codePayz

- paysafecard

Note that if you are choosing to deposit into your EcoPayz account using Interac Online, Neosurf or paysafecard, you’re probably better off finding a casino that accepts those payment methods directly instead of going through EcoPayz.

[su_panel background=”#fbfbfb” color=”#281e1c” border=”1px solid #403a3a” shadow=”1px 1px 3px #eff6f6″ radius=”5″]

Depositing to an online casino account using ecoPayz

The process for depositing funds into an account at ecoPayz online casinos is a straightforward one, using Genesis Casino as an example

- Go the banking module / tab

- Click on the Deposit button next to the ecoPayz logo

- Enter the amount you want to deposit

- Click on Next

- You will now be redirected to your ecoPayz account (depending on your settings, you may be required to enter your username and password)

- Choose whether you are using ecoAccount, ecoCard or an ecoVirtualCard to make your payment

- Follow the remaining instructions to complete your transaction[/su_panel]

FAQ

Is ecoPayz Legit?

Whilst there are quite a lot of complaints about their customer service, they do provide a service that makes it easy to transact with casinos and the debit card they provide comes in handy allowing you to make direct purchases or withdrawals from an atm.

Are there any ecoPayz bonus promotion?

No. Unfortunately there aren’t any casinos that provide promotions based off ecoPayz deposits

How do you upgrade to different membership levels?

Going from Classic -> Silver requires you to provide identifcation documents for verification.

Going from Silver -> Gold requires:

- Verified credit/debit card

- Verified address/identity documentation

- Deposit of minimum 2,500 Euros

- Silver membership status for minimum 30 days.

- A cumulative transfer of 25,000 Euros to merchants.

Going from Gold -> Platinum requires:

- Gold membership for 30 days

- Activation of ecoCard

- Transferred in total a minimum of 50,000 Euro to merchants

Going from Platinum -> VIP requires:

- Platinum membership for 30 days

- Transferred in total a minimum of 250,000 Euro to merchants

Who owns ecoPayz?

EcoPays is operated by UK based company PSI-Pay Ltd.